Have you ever found yourself in a situation where the customer wants a preliminary bill of sale before the product or service is delivered?

That’s where a proforma invoice comes in handy.

This guide aims to provide a deeper understanding of what a proforma invoice is, when and how to use it, its relevance in South Africa, and the advantages and disadvantages it brings to the table.

A proforma invoice is a preliminary document provided by a seller to a potential customer, presenting the particulars and expenses associated with a product or service.

Unlike an actual invoice, it’s issued in advance of the completion of work, serving as a declaration of intent to provide goods or services that are yet to be delivered.

Create free invoices with Conta

Say goodbye to the hassle of creating invoices!

Conta streamlines the process, allowing you to breeze through it in under 2 minutes. Just input customer details, along with product and price information, and send your professional invoice swiftly.

Proforma invoices are generated at the initial stages of a transaction, usually when there is a commitment from the customer to proceed with the purchase.

They provide an overview of the expected transaction details, allowing for necessary adjustments before the final invoice is prepared and delivered upon the completion of the transaction.

Consider a scenario where a restaurant accepts the cost of catering on a proforma invoice, scheduling food delivery for a later date. Payment is settled upon receipt of the official invoice, ensuring alignment with the proforma invoice amount.

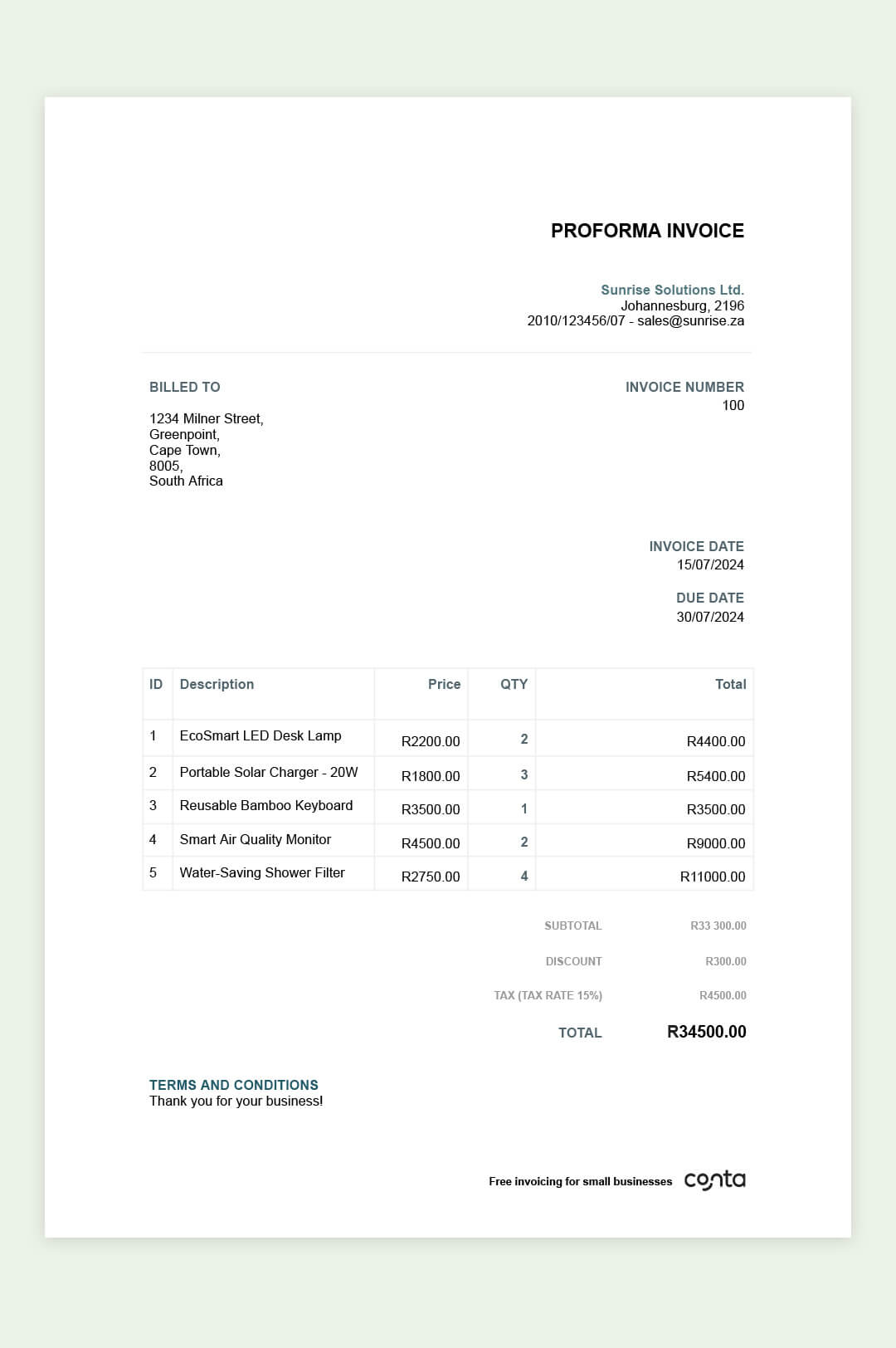

Here is an example of how the proforma invoice could look like:

Generating a proforma invoice is a straightforward process, similar to regular invoices.

Many accounting or invoicing software packages offer pre-designed proforma invoice templates. Alternatively, tools like Microsoft Word and Google Docs allow you to craft your own.

Here is a simple step-by-step guide on how to create proforma invoices:

Create a template or use invoicing software to craft a polished invoice, with your logo and branding. Clearly label the document as a “Pro forma invoice” to make it clear that the regular invoice will come later.

Ensure the recipient can easily identify the sender by prominently featuring the company name and information. Additionally, include the customer’s details.

Provide transparency by detailing the cost breakdown. Specify the services you will deliver, their quantity, duration, and unit price. Include sections for the total cost of goods and services (pre-tax and pre-discounts), any applicable discounts, taxes, and the net total.

Proforma invoices can be sent through various channels, including email, fax, or mail. Timely delivery allows the buyer to review and decide. Clear, concise proforma invoices containing all relevant information about the goods or services facilitate the decision-making process.

A typical proforma invoice includes:

What is the difference between an invoice and a proforma invoice?

An invoice is sent post-confirmation, serving as a legally binding document requesting payment for delivered goods or services.

In contrast, a proforma invoice is a preliminary document sent before confirmation, outlining deliverables, prices, shipping details, and delivery date. Although not legally binding, it aids in streamlining processes, acting as a quote for internal purchase approval, and saving time and costs.

No, proforma invoices are not legally binding. They serve as a preliminary document sent before sale confirmation, outlining deliverables, prices, shipping details, and delivery date. The buyer can confirm, negotiate, or reject the offer.

Can one claim tax on a proforma invoice?No, tax cannot be claimed on a proforma invoice. It is not legally binding and serves as a preliminary document before sale confirmation. Tax invoices, being legally binding, are used for requesting payment after goods or services are delivered.

Can a seller cancel a proforma invoice?Yes, a seller can cancel a proforma invoice. As it is not legally binding, the seller can cancel it if the buyer rejects the offer or if there are negotiations that lead to no agreement.